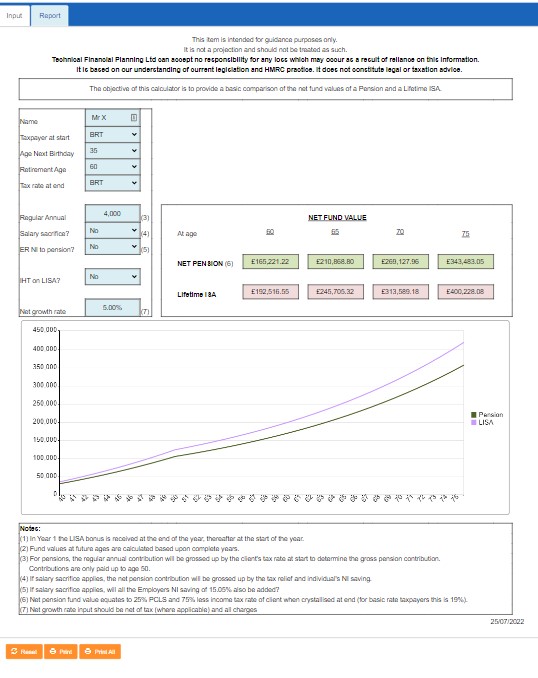

The Pension v Lifetime ISA (LISA) calculator provides a basic comparison of the fund values of a pension and LISA based upon a regular annual investment amount.

The March 2016 Budget announced the introduction of LISA. It will be available to UK resident savers who are under the age 40 in April 2017 (i.e 18-39).

The objective is to help under the 40s save for a first home or retirement.

LISA information

The maximum investment will be £4,000 a year (i.e. no monthly cap) and can be invested in Stocks & Shares.

Any savings put in before age 50 (a maximum of 32 years’ contributions) will receive an added 25% bonus from the government. This will be paid at the end of the tax year but can be paid in the year when a home purchase is made.

The savings and bonus can be used towards a deposit on a first UK residential property worth up to £450,000.

If the client withdraws funds at any time before age 60, other than for a deposit on a first home, then there will be a 25% penalty of the amount withdrawn!

Output

This calculator compares fund values of contribution to a;

- Pension, or

- Lifetime ISA, or

- Lifetime ISA until age 50 (when the bonus stops) & thereafter to a pension.