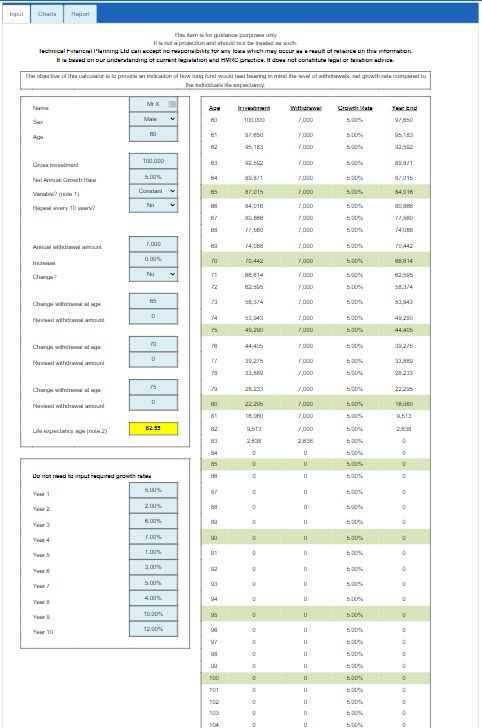

The Income Sustainability calculator will show clients’ expected age at the date of death using the Office of National Statistics (ONS) latest statistics table for the United Kingdom (2020-20122.

By inputting the client’s age, sex, investment fund, expected net growth rate, and regular annual withdrawal amount, the calculator will show the age at which the fund is expected to last.

Within the Income Sustainability calculator, there are the options;

Growth rate

To be able to show the impact of a ‘varying’ growth rate on the fund.

- Constant – so the rate input remains the same throughout the term

- Positive – In the early years there is a greater rate of growth, which then reduces so that over the initial 10 years the average growth rate is the same

- Negative – In the early year there is a lower rate of growth, which then increases so that over the initial 10 years the average growth rate is the same

- Best – using the 10 best consecutive calendar years of the FTSE 100

- Worse – using the 10 worse consecutive calendar years of the FTSE 100

- Manual – which allows you to input your own growth rates over a 10-year period

This will show the impact of ‘pound cost ravaging.

Withdrawals

It is possible to change the level of withdrawals at a particular age.

Withdrawals can also be levelled or increased.