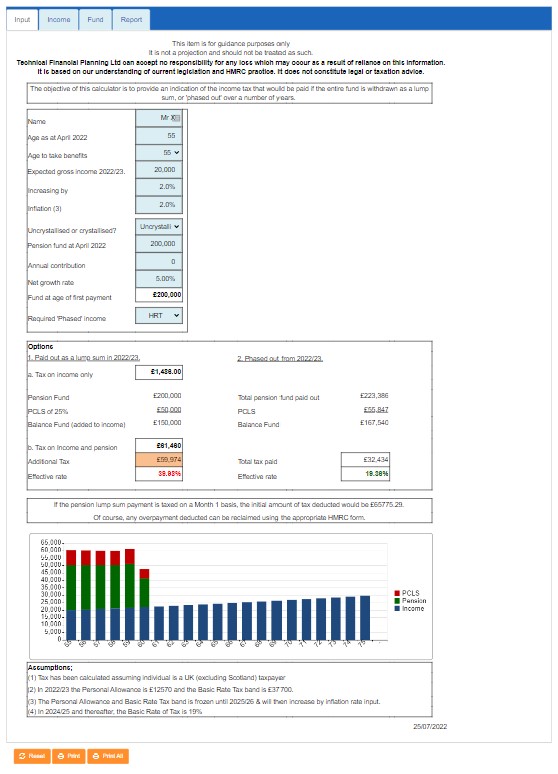

The UFPLS Options calculator will provide an indication of the amount of income tax paid by the client if the entire money purchase pension fund is withdrawn as an Uncrystallised Fund Pension Lump Sum (UFPLS).

Emergency Tax Code (Month 1) basis

The UFPLS Options calculator will also show the amount of tax to be paid under the emergency tax code (Month 1) basis. This is used when the pension provider does not hold an up-to-date tax code, and will only apply 1/12th of the personal allowance and 1/12th of income bands. This will result in an overpayment of tax which will be repaid at the end of the tax year when the individual has completed their tax return or can be reclaimed earlier by completing the appropriate online forms.

Background

As of 6th April 2015, it is possible for clients with Money Purchase arrangements to withdraw all their pension funds as a lump sum. For uncrystallised funds, 25% can be paid as a tax-free lump sum and the balance fund is subject to income tax at the client’s marginal rate. No tax-free lump sum is available from Crystallised funds.

Output

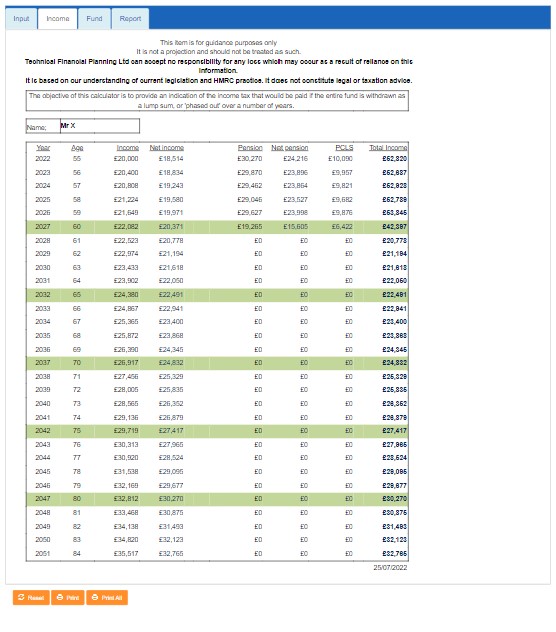

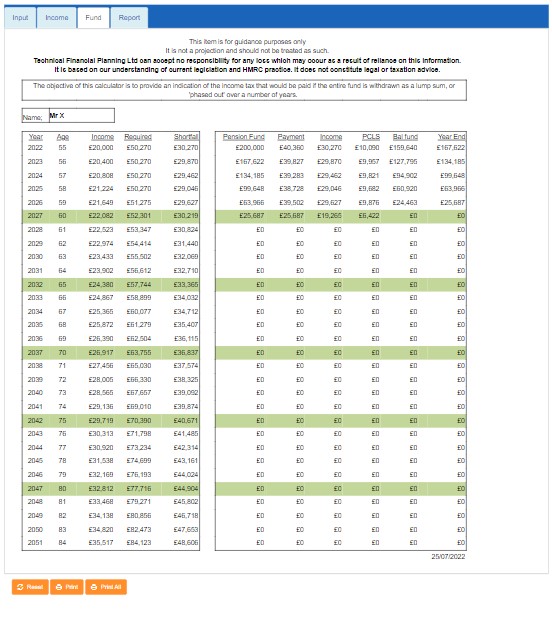

As well as showing the amount of tax if all funds are taken as UFPLS, the UFPLS Options calculator will also show the total tax paid if the pension fund is withdrawn over a number of years.

The amount of taxable pension withdrawn each year could be the balance amount up to the client’s personal allowance, or Higher Rate Tax threshold, or £100,000 when the personal allowance starts to reduce, or the Additional Rate Tax threshold, or by a specific amount.

This will, of course, take account of the client’s expected income.

The calculator allows for;

- Uncrystallised or Crystallised funds.

- Growth rate whilst ‘phasing’ pension fund fund

- It can also provide projections of tax & benefits for those clients who are going to take benefits at a later date, maybe because they have not attained age 55 or do not want to access benefits yet, and

- for annual contributions to be paid during this period of ‘deferment’.

On a separate tab, it will also show the calculations of how many years that ‘phase’ level of income can be maintained.