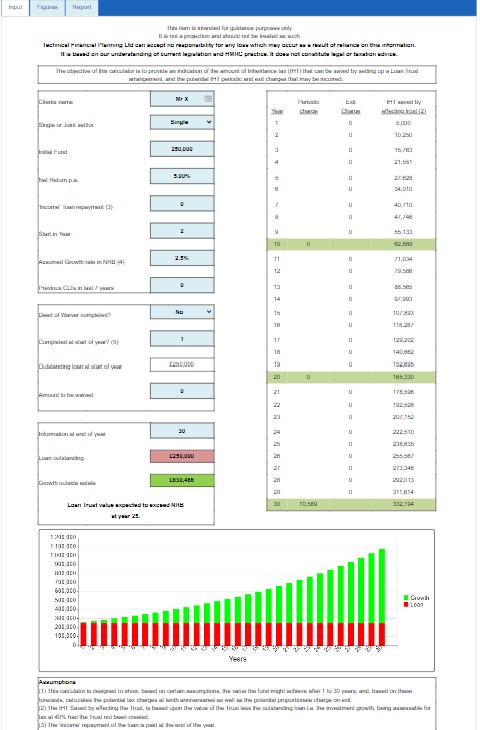

This calculator provides an indication of the amount of Inheritance tax (IHT) that can be saved by setting up a Loan Trust arrangement, and the potential IHT periodic and exit charges that may be incurred.

Loan Trust arrangements can be useful plans for clients who want to do something about inheritance tax but do not want to give up immediate access to their savings and investments.

Periodic charges

Loan Trusts using a discretionary trust may be subject to an IHT periodic charge at each ten-year anniversary of the Trust. The charge will apply if the value of the Trust (less the outstanding value of the loan) is greater than the Nil Rate Band (NRB) for inheritance tax.

Therefore for a ‘larger’ Loan Trust, consideration could be given to establishing ‘smaller’ Loan Trusts on different days. This can be demonstrated by showing two outputs, one for the higher initial loan, & the other based on the smaller loan.

The calculator allows for any previous CLTs and if the loan repayments / “income” to be delayed.

Output

Having input investment/loan amount, expected growth rate and repayment amount i.e. “income”, the calculator will produce a chart showing the repayment of the loan (the red bars) and the growth of the trust (green bars) which would not be included in the estate for inheritance tax.

The calculator also produces a table showing potential periodic and exit IHT charges and provides an indication of the year in which the value of the trust exceeds the NRB. The table will also show the amount of IHT saved by affecting the Loan Trust.

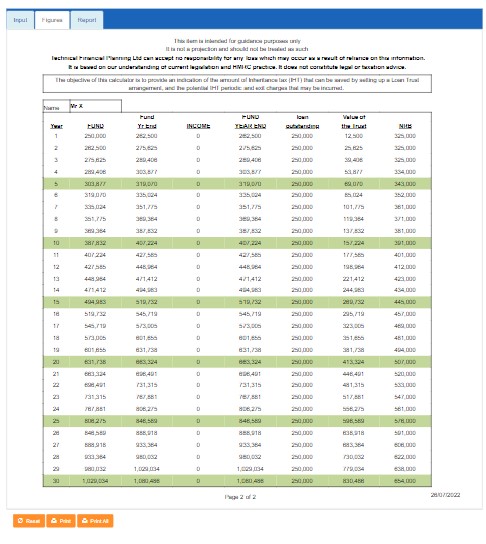

Figures showing the cash flow position of the Loan Trust are available by clicking the ‘Figures’ tab at the top of the Loan Trust calculator.