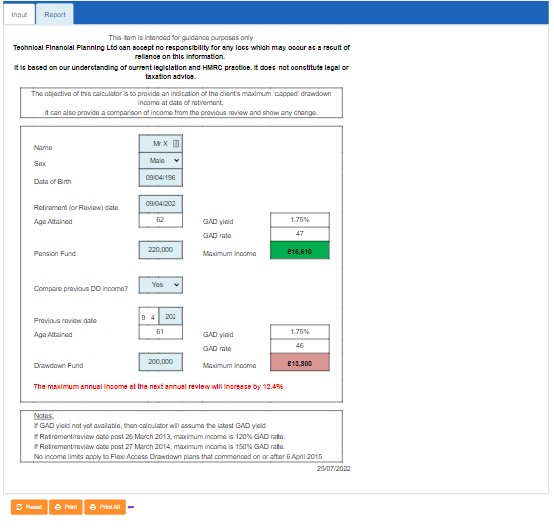

The Maximum Drawdown Income calculator provides an indication of the client’s maximum ‘capped’ drawdown income at the date of retirement.

It can also provide a comparison of income from the previous review and show any change.

The calculator is only relevant for those individuals whose ‘capped’ drawdown plans started before 6 April 2015 and have not withdrawn income that exceeded the income limits. These plans still have limits on income and are subject to three yearly reviews (annually after age 75).

On inputting the retirement or review date details into the Maximum Drawdown Income calculator, it will determine the basis and tables (see below) to use to calculate the maximum ‘capped’ income available at that particular date. This income level is important because if the client takes more than that amount, they will trigger the Money Purchase Annual Allowance limit.

For a history of GAD yields, click here.

Changes

Pre April 2011

The maximum GAD income was 120% of the 2006 GAD table rate.

April 2011

There was a ‘double hit’ as the percentage amount reduced to 100% of the 2011 GAD table rate, and the new 2011 GAD table rates were lower than the 2006 tables!

Clients in Drawdown Pre 2011 would transition onto the new basis at the end of their current reference period, or the next policy anniversary if they transferred. Some clients who have moved to the new basis have had a significant reduction in their income levels.

Further changes

- With effect from 21st December 2012, GAD rate equalisation meant that Male rates to be used.

- 26th March 2013, the GAD maximum then increased back up to 120%.

- From 27th March 2014, the GAD maximum increased further to 150%.

- No new ‘capped’ Drawdown plan can be set up on or after 6th April 2015