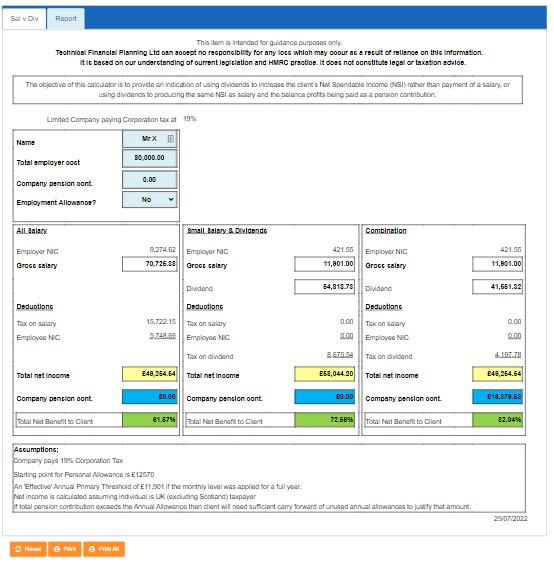

The Salary vs Dividends calculator provides a quick and simple indication demonstrating the tax advantages of increasing a client’s Net Spendable Income (NSI) by extracting profits as dividend payments as opposed to salary.

It also shows a further alternative option of providing the same NSI as the salary-only option, by taking a small salary with dividends and the balance profits being paid as a pension contribution.

There is the option to show the impact of the Employment Allowance.

For a more detailed solution, which allows changes to salaries, dividends, and pension contribution amounts, and includes the spouse – please see the Profit Extraction calculator.