The Annual Allowance is the amount of pension savings that benefits from tax relief in any one tax year. The Annual Allowance for 2024/25 is £60,000*.

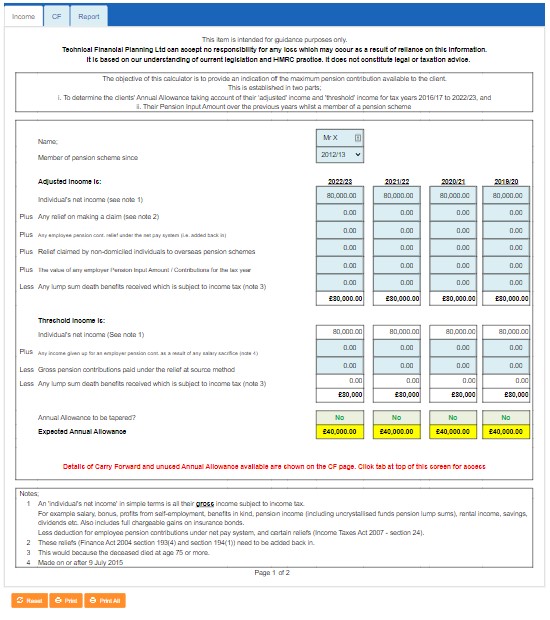

Since 6th April 2016, the Annual Allowance is tapered for certain individuals, so the Carry Forward calculator is in 2 parts;

- – The first part calculates the ‘tapered’ Annual Allowance, which depends on the clients’ income, for the current and previous 3 tax years (& potentially back to 2016/17) and

- – the second part calculates the Carry Forward amount of any unused Annual Allowance available.

1. Tapered Annual Allowance

Tax relieved pension savings will be reduced for those with ‘adjusted income’ of currently over £260,000 p.a.*

The Annual Allowance will be reduced by £1 for every £2 income over ‘adjusted income’ limit with a maximum reduction of £50,000. This means that Annual Allowance will reduce from £60,000 p.a. to £10,000 p.a.*.

The ‘adjusted income’ definition adds back any pension contributions, to prevent individuals from avoiding the restriction by exchanging salary for employer contributions.

However, to provide certainty for individuals with lower salaries who may have one-off spikes in their employer pension contributions, a ‘threshold income’ limit of currently £200,000 p.a.* will apply.

If the individual’s net income is no more than the threshold income limit (excluding pension contributions) they will not normally be subject to the tapered annual allowance. However, anti-avoidance rules will apply so that any salary sacrifice set up on or after 9 July 2015 will be included in the threshold definition.

This calculator will show whether the Annual Allowance will be restricted, and the expected Annual Allowance for the current and 3 previous tax years (& potentially earlier years) which, together with the pension contributions input, will be used in the second part.

* For Allowances & Income limits in earlier tax years, click here.

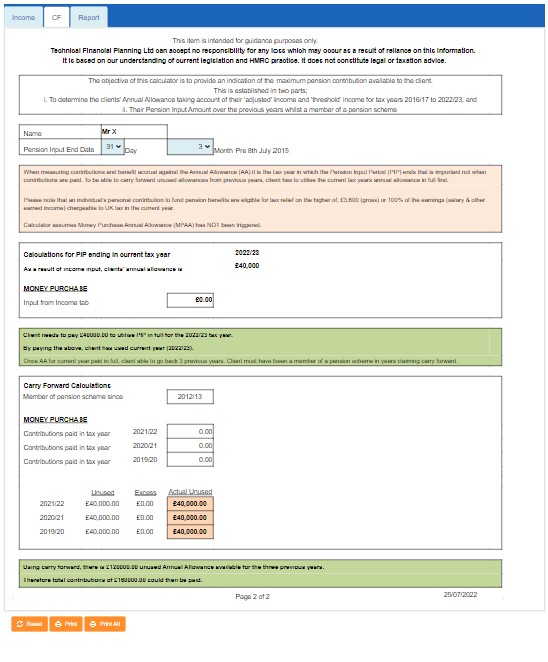

2. Carry Forward

Using information input on the income page(s), this will indicate the amount of unused pension contribution that can be paid in respect of a client to Money Purchase schemes for the current tax year based upon the Pension Input Amount paid in the previous years.

The calculator does not cater for the input of Defined Benefit pension amounts or individuals who have triggered the Money Purchase Annual Allowance (MPAA).