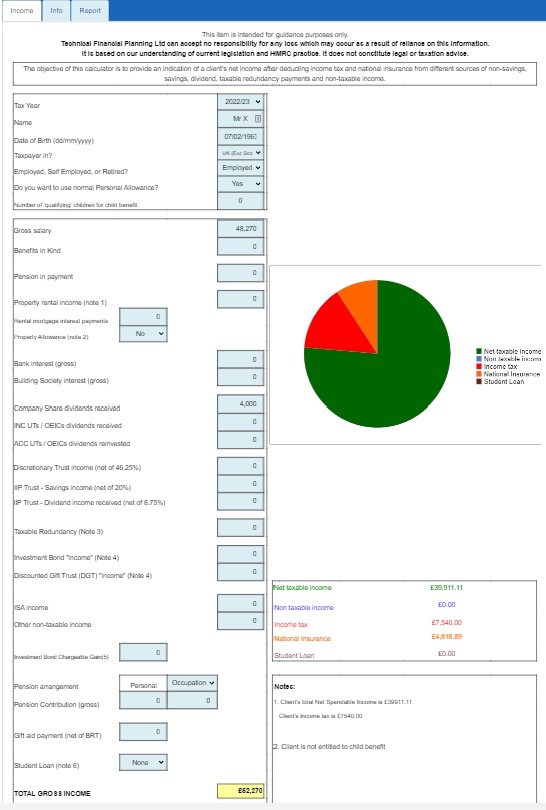

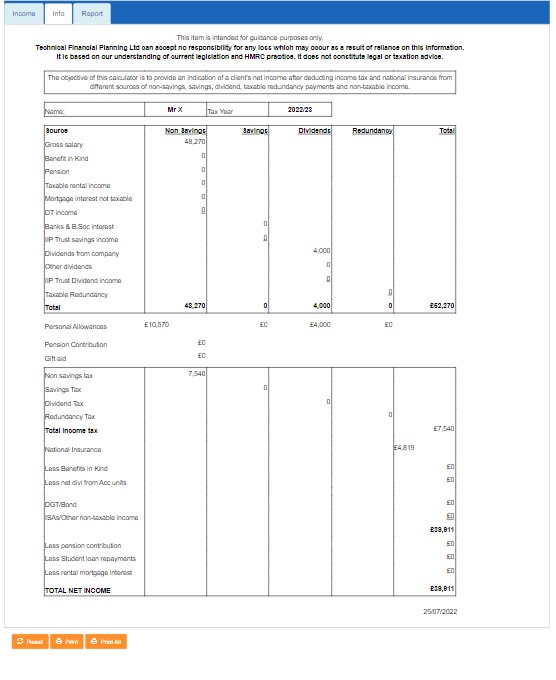

The Income Tax calculator provides an indication of a client’s net income after deducting income tax and national insurance from different sources.

Calculations are based upon inputs of the client’s non-savings, savings, dividends and non-taxable income from different sources such as ‘income’ or ‘accumulation’ units or Trust income.

The calculator takes account of;

- Whether a client is employed or self-employed for NI purposes.

- The option to overwrite the Personal Allowance.

- Child benefit amounts (if any) are shown in the Notes.

- Repayment of Student Loans.

The calculator will also show the income tax changes introduced by the Scottish government regarding the structure of (non-savings) income tax for taxpayers in Scotland.

Income calculations are shown assuming no individual pension contribution are paid and with contribution paid, to demonstrate the tax saving of making the pension contribution.

Claiming for previous years

As HMRC will allow reclaim of income tax back to 2020/21 (providing the claim is made by 5th April 2025). The calculator will allow you to select any tax year from 2020/21 to perform these tax calculations.