A Relevant Life Policy is a tax-efficient way of providing death-in-service benefits on an individual basis.

Relevant Life Policies are only available to Employers and is an excellent way of providing life assurance cover for Employees and directors payable to their family and dependants on death or terminal illness.

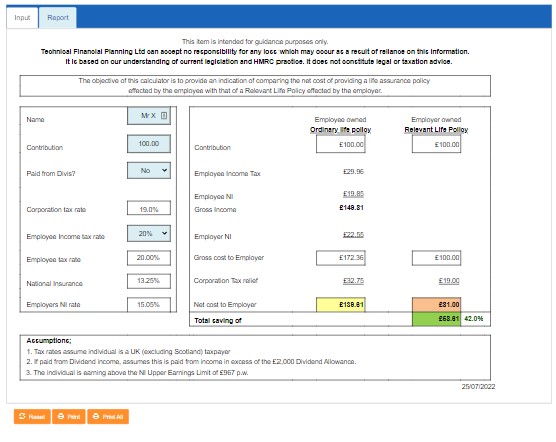

The premiums paid to a qualifying Relevant Life Policy will be tax deductible for the Employer and will not be assessable to the Employee. Therefore it is a more attractive option than the employee affecting a life assurance plan which is then paid for by the employer (as a benefit in kind).

The calculator compares these two options and shows the tax savings achieved.