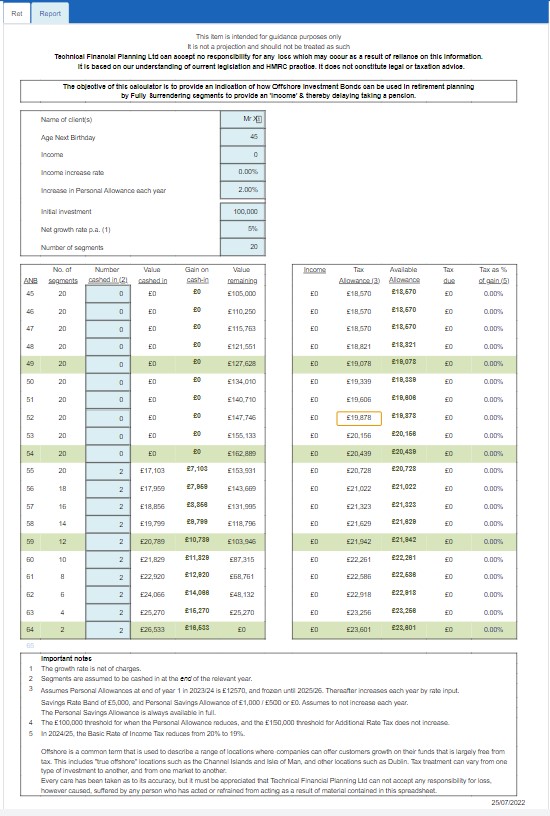

The Offshore Bond – Full Surrenders calculator provides an indication of how Offshore Investment Bonds can be used in retirement planning by Fully Surrendering segments to provide an ‘income’.

Offshore Investment Bonds can be very useful investments when arranging financial plans for UK-based Non-Tax Payers.

This is because Non-taxpayers are able to utilise any of their unused Personal Allowance, Savings Rate Limit (for Savings income) and Personal Savings Allowance against the Chargeable Gain of an Offshore Investment Bond.

Chargeable Gains

A Chargeable Gain can arise on Full Surrender (of segments) of an Offshore Investment Bond.

However, having unused allowances to be offset against Chargeable Gains of an Offshore Investment Bond can be very useful for individuals who Fully Surrender segments to provide either;

a. a tax efficient ‘income’ (in retirement), or

b. fund Education fees.

Once the necessary details are input, this calculator will show the unused allowance available each year and the tax that will be due on the required withdrawals to provide the necessary ‘income or fees.

Therefore using any unused allowances available on Full Surrender of segments could result in little/small amounts of tax being paid within the Offshore Bond wrapper & then no tax paid on Full Surrender.