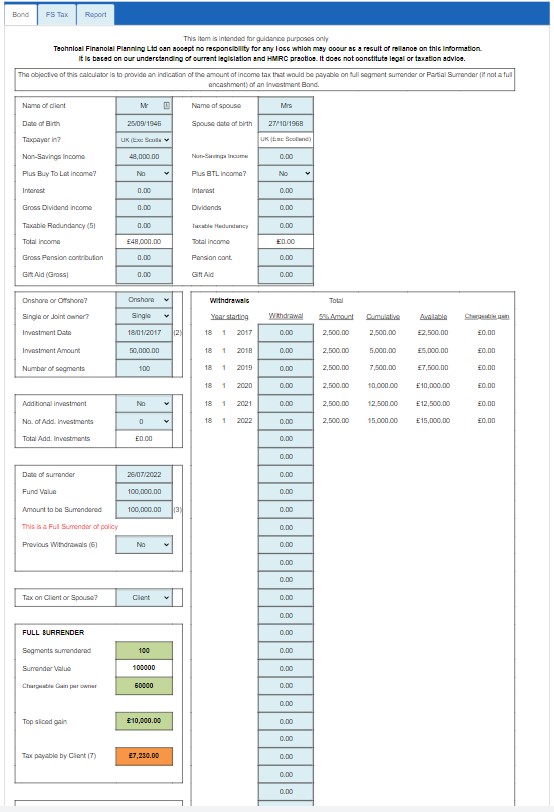

The investment bond calculator will give an indication of the tax liability due to the client surrendering the investment depending upon their current total income.

This will be for either an onshore UK investment Bond or an Offshore Investment Bond.

Inputs

Details of the investment bond owners need to be input, together with information about any additional investment, any previous part surrender withdrawals, and the amount now to be surrendered

Output

The calculator will then show the number of segments being surrendered, the total chargeable gain per owner, top-sliced gain and an indication of the expected tax to be paid by the individual.

If all of the investment bonds are not being surrendered, the calculator will also show the situation for a Part Surrender using a 5% ‘tax deferred’ withdrawal basis.

Pension Contributions

The individual’s pension contribution can also be input which will have the impact of increasing the individual’s Basic Rate Tax band and reducing their “adjusted net income”. By including the pension contribution can show how the investment bond tax liability can be reduced.

Large Withdrawals

If the individual’s income and chargeable gain exceed £100,000 then a warning will be shown to highlight that their Personal Allowance will reduce/be lost.

This will be shown even if the clients’ income is already above the limit in which they lose their PA because it can act as a reminder and possibly instigate the payment of a pension contribution to bring their ‘adjusted net income’ below the £100k limit.

If the individual is Fully Surrendering more than one investment bond in a tax year, then the Multiple Investment Bond calculator should be used.