Each year, clients should always consider utilising their tax allowances and tax-efficient investments. If a client has money invested, such as in Collectives, and is not using their ISA allowance in full then they should consider moving money from that investment into an ISA.

Particularly as the current maximum ISA allowance is £20,000 per annum.

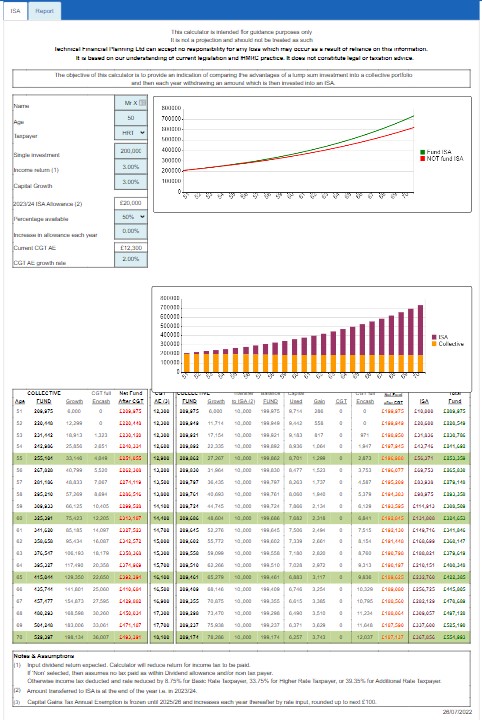

The Collectives Funding ISA calculator provides an indication of;

- A lump sum investment that is retained into a Collective portfolio, compared to

- Each year withdrawing an amount which is then invested into an ISA plus the remaining Collective portfolio.

Due to the Capital Gains Tax Annual Exempt Amount reducing from £12,300 (in 2022/23) to £6,000 (in 2023/24) and now to £3,000 (in 2024/25), there is more likely to be a CGT liability arising when moving funds (a Partial Disposal) from a Collective to an ISA. Therefore, the Funding ISA calculator will calculate;

- The potential capital gain on the Partial Disposal from a new or existing Collective portfolio, and

- The required ‘grossed up’ Partial Disposal /withdrawal to allow for any potential CGT payable.

The Funding ISA calculator demonstrates the value of moving money /a Partial Disposal each year from a Collective investment into an ISA investment by comparing;

- the value of the Collective investment (without moving money to an ISA), &

- the total value of the ISA investment and the remaining Collective investment.

These values, of using and not using the ISA allowance, are shown in a line chart. A bar chart also shows the breakdown of the total fund between the ISA and Collective investment.

The figures/calculations of the investment fund values are also shown.